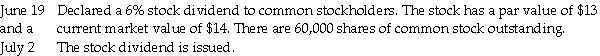

Prepare the following stock dividend journal entries for Tamera,Inc.

Definitions:

Finance

The management of money and other assets by individuals, companies, or governments.

Compounded Monthly

A method where interest is calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a loan or deposit, recalculated every month.

Month-end Contributions

Investments or payments made at the end of each month, commonly used in savings plans or investment strategies.

Compounded Monthly

Interest calculation method where interest is added to the principal balance every month.

Q4: The sale of assets for liquidation purposes

Q6: The journal entry to record the purchase

Q32: If an asset is exchanged for a

Q34: To record the purchase of treasury stock:<br>A)debit

Q71: If an asset is being sold or

Q74: The corporation will repay the principal amount

Q78: From the following,determine the book value per

Q83: The business bought store equipment on account.<br>Debit

Q107: Identify each of the following transactions as

Q127: Davis Corporation sells $200,000,12%,10-year bonds for 103