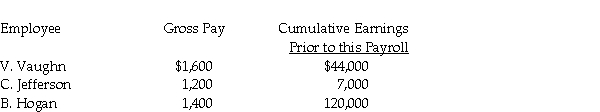

Using the information provided below,prepare a journal entry to record the payroll tax expense for Mr.B's Carpentry.

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $117,000 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Definitions:

Marbury v. Madison

A landmark Supreme Court case in 1803 that established the principle of judicial review, allowing courts to declare laws unconstitutional.

Articles of Confederation

The original constitution of the United States, ratified in 1781, which was replaced by the current Constitution in 1789 due to its weaknesses.

Federal Court System

The judiciary system of the United States, consisting of the Supreme Court, appellate courts, and district courts.

Commercial Treaties

Agreements between countries that govern the terms of trade, investment, and economic relations.

Q3: If beginning inventory is $6,000,ending inventory is

Q5: Beginning inventory is adjusted by debiting Income

Q11: Which of the following transactions would most

Q21: Jack's Online Service on April 30

Q27: Merchandise purchased for resale under the periodic

Q37: The bank would issue a credit memorandum

Q58: On November 1,Phone Center received $4,800 for

Q82: A FUTA tax credit:<br>A)is given to employers

Q112: The adjustment for accrued salaries would be

Q112: The Income Summary account debited and the