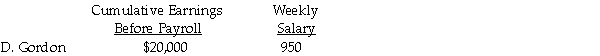

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

a)FICA: OASDI,6.2% on a limit of $117,000;Medicare,1.45%.

b)Each employee contributes $40 per week for union dues.

c)State income tax is 5% of gross pay.

d)Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry.

Definitions:

A social networking site that allows users to connect with friends, family, and others who work, study, and live around them.

Adolescent Girls

Adolescent girls refer to young females in the transition stage from childhood to adulthood, typically between the ages of 10 and 19.

Ideal Male

A social construct that outlines the attributes, behaviors, and traits considered desirable or expected in males within a specific culture.

Ideal Female

A socially constructed concept of the perfect or most desirable attributes and characteristics of a female.

Q1: Compute the employees' FICA-Medicare.

Q7: The revenue accounts debited and the Income

Q25: A form used with a business by

Q62: Explain why,when a customer returns merchandise after

Q65: Sam's Tutoring Service's $500 petty cash fund

Q83: The general ledger balances are used to

Q85: The Capital account debited and the withdrawals

Q92: The accounts payable subsidiary ledger should equal

Q97: Prepare the general journal entry to record

Q119: Closing entries:<br>A)need not be journalized since they