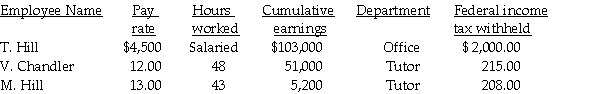

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-

Definitions:

Reasonable Price

A price that is fair and acceptable to consumers, often considered in relation to the value of the product or service.

Unbundling

The process of separating a product or service into individual components which can be sold separately.

Pricing Strategy

The method companies use to price their products or services, considering factors like market demand, competition, and cost of production.

Break-Even Analysis

A financial calculation to determine the point at which revenue received equals the costs associated with receiving the revenue, indicating no net loss or gain.

Q11: A form used to organize and check

Q18: What is the purpose of adjusting entries?

Q20: Purchases discounts:<br>A)decrease net income.<br>B)increase net income.<br>C)increase accounts

Q42: After the adjustment for depreciation has been

Q54: The entry to close the Withdrawal account

Q57: Closing entries will update the Capital account

Q63: The account for Payroll Tax Expense includes

Q75: Merchandise Inventory (ending)appears on both the Income

Q76: Which taxes are considered 941 taxes?<br>A)FICA,FUTA,and SUTA<br>B)FICA

Q116: Prepare the necessary general journal entry for