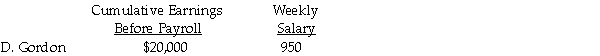

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

a)FICA: OASDI,6.2% on a limit of $117,000;Medicare,1.45%.

b)Each employee contributes $40 per week for union dues.

c)State income tax is 5% of gross pay.

d)Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry.

Definitions:

Ingredients

The components or elements that are combined to create a product, often used in the context of cooking or manufacturing.

Final Market Value

The total worth of a product or service determined at the point of sale, reflecting the end price paid by consumers.

Production Stages

Production stages refer to the various phases involved in creating a product, from initial design and raw material sourcing to manufacturing, finishing, and eventually, distribution.

Gross Domestic Product

The full economic or market value of all the finished goods and services made within the geographical confines of a country in a particular period.

Q1: Recording to the accounts receivable subsidiary ledger

Q12: FICA taxes are levied only on employees

Q30: Ending inventory:<br>A)increases Cost of Goods Sold.<br>B)decreases Cost

Q36: The entry to establish the petty cash

Q36: <span class="ql-formula" data-value="\begin{array} { | l |

Q38: A monthly depositor:<br>A)is an employer who only

Q47: An example of an internal control is:<br>A)the

Q102: The Schedule of Accounts Payable is listed

Q103: The first entry to close accounts is

Q131: An allowance or exemption represents a certain