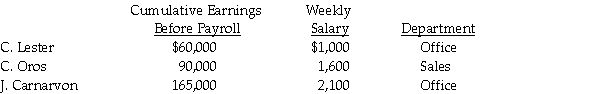

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

a)FICA: OASDI,6.2% on a limit of $117,000;Medicare,1.45%.

b)Federal income tax is 15% of gross pay.

c)Each employee pays $20 per week for medical insurance.

Definitions:

Product Cost Concept

The accounting principle that determines the cost of a product by adding the costs of raw materials, labor, and overhead incurred in its production.

Rate of Return

The increase or decrease in the value of an investment during a certain timeframe, represented as a percentage of the original investment's cost.

Markup Percentage

The percentage added to the cost of goods to cover overhead and profit, determining the selling price.

Factory Overhead

Costs associated with production that are not directly tied to individual products, including utilities, maintenance, and salaries of supervisory staff.

Q26: Santa Materials sold goods for $2,000 plus

Q59: Determine the amount of cash collected at

Q62: Which of the following is a real

Q76: The goods a company has available to

Q82: If a display rack was purchased for

Q84: The buyer issues a debit memorandum to

Q89: Sales Tax Payable represents an asset on

Q96: After posting adjusting entries,the temporary accounts will

Q102: After closing the revenue and expense accounts,Income

Q113: The debit amount to Payroll Tax Expense