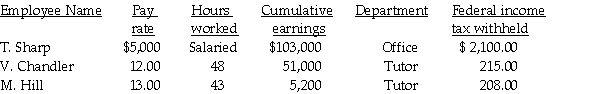

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Definitions:

Ages

Refers to the length of time that an individual, object, or entity has existed.

Histogram

A graphical representation of data using bars of different heights to show the frequency of values in intervals.

Weight-Loss

Refers to the reduction of the total body mass due to a mean loss of fluid, body fat, or lean mass.

Pounds Lost

Represents the amount of body weight, measured in pounds, that an individual has successfully reduced.

Q11: Prepare the necessary general journal entry for

Q43: The payroll taxes the employer is responsible

Q47: An example of an internal control is:<br>A)the

Q67: A summary of selected ledger accounts appear

Q69: Maria's Blankets and Bedding had a sale

Q75: If the ending balance in the Cash

Q77: The adjustment for unearned rent revenue is

Q85: Which of the following adjustments may be

Q111: Determine the beginning owner's equity of a

Q120: Unearned Rent Revenue results because:<br>A)no fee has