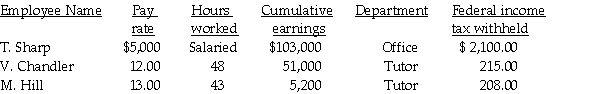

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the net pay.

Definitions:

Liquid Consistency

The physical property of a substance that defines its thickness and flow, particularly in the context of dietary textures and medical formulations.

Blood

A vital fluid in the body that delivers necessary substances such as nutrients and oxygen to the cells and transports metabolic waste products away.

Nasogastric Tube

A medical tube that is inserted through the nose and into the stomach for feeding or removing stomach contents.

Nursing Assistive Personnel

Staff who assist registered nurses (RNs) and licensed practical nurses (LPNs) in providing patient care, typically with less formal training.

Q15: It's the end of the accounting period

Q16: Prepare the necessary general journal entry for

Q23: To compute federal income tax to be

Q34: Prepare the necessary general journal entry for

Q43: The adjusting entry for accrued salaries is

Q61: S.Ferrari,an employee of Plum Hollow Country Club,earned

Q64: _<br> <span class="ql-formula" data-value="\begin{array}{|l|l|l|}\hline\text {

Q82: Sales Returns and Allowances is a contra-revenue

Q89: Checks that have been processed by the

Q123: Purchase Discounts are taken on:<br>A)shipping expense.<br>B)Purchases Returns