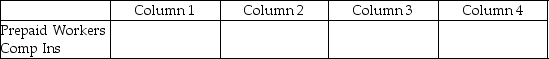

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

Definitions:

Education Credit Deduction

A type of deduction that allows eligible taxpayers to subtract education expenses from their taxable income, enhancing affordability for higher education.

Dependent

An individual, usually a child or spouse, who relies on another person (typically a family member) for financial support and qualifies for certain tax benefits on that person’s tax return.

College Fees

Expenses related to attending college, including tuition, room and board, and other related costs.

Qualifying Individual

In tax contexts, this refers to someone who meets certain criteria for eligibility under various credits, deductions, or filing statuses.

Q10: The bank charged another company's deposit to

Q19: Business transactions are first recorded in the:<br>A)ledger.<br>B)journal.<br>C)trial

Q22: Prepare the necessary general journal entry for

Q31: Payment for merchandise sold on credit for

Q35: Gene's Tax Service has two types of

Q49: The inside columns on the financial statements

Q53: The use of a payroll register to

Q101: The entry to record the payment of

Q104: Sold merchandise subject to a sales tax,accepting

Q109: From the following accounts,prepare in proper