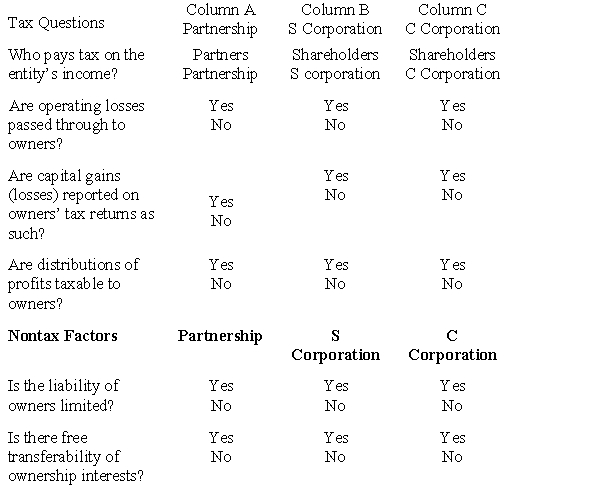

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Definitions:

Tax Penalty

A tax penalty is a fine or charge imposed by governmental authorities on individuals or organizations for failing to comply with tax laws.

Deferred Tax Asset

An asset on the balance sheet representing taxes paid or carried forward but not yet realized. This can arise due to timing differences between the recognition of income and expenses for financial reporting and tax purposes.

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government in a specific tax year.

Warranty Expenses

Costs associated with the obligation to repair or replace products that fail to meet specified standards.

Q12: Similar to like-kind exchanges, the receipt of

Q18: The basis for the acquiring corporation in

Q20: Which of the following items will be

Q70: The market size variance is favorable when

Q70: Briefly describe the reason a corporation might

Q78: On December 16, 2016, the directors of

Q79: Gerald, a cash basis taxpayer, owns 70%

Q80: The formula in determining the DPAD for

Q82: Under the current tax law, an asset

Q126: What are some of the pricing practices