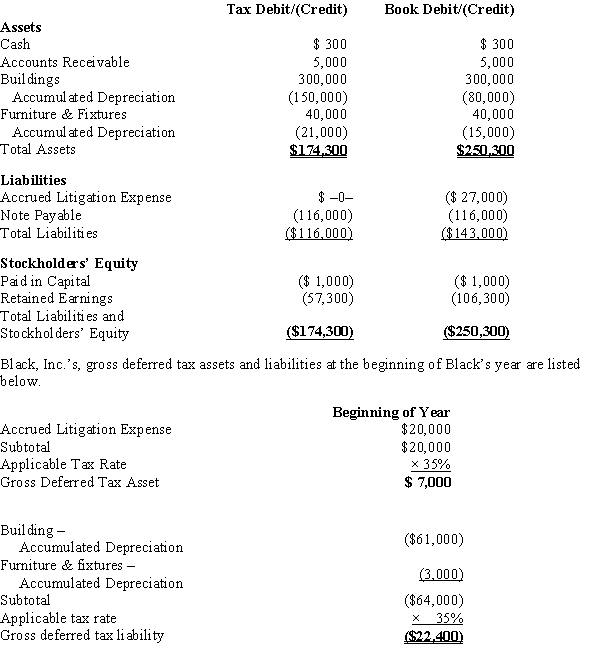

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 35% corporate tax rate and no valuation allowance.

?  ?

?

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense. Provide the journal entry to record Black's current tax expense.

Definitions:

Sexual Abuse

Any non-consensual sexual act or behavior targeted at an individual, often creating significant trauma and potentially leading to long-term psychological effects.

Psychologist or Sex Therapist

Professionals specialized in providing mental health care and counseling for sexual health and relationship issues.

Paramesonephric Defects

Anomalies associated with the development of the paramesonephric ducts, which can lead to reproductive system abnormalities in females.

Fallopian Tubes

A pair of tubes along which eggs travel from the ovaries to the uterus, crucial for the process of fertilization and early development of the embryo.

Q14: Michelle receives a proportionate liquidating distribution when

Q25: Boot Corporation is subject to income

Q28: Carlos receives a proportionate liquidating distribution consisting

Q48: Unless the "widely available" provision is satisfied,

Q77: Distribution of cash of $25,000 for a

Q82: § 501(c)(5) labor organization<br>A)League of Women Voters.<br>B)Teachers'

Q101: Define "trade or business" for purposes of

Q118: Most limited liability partnerships can own stock

Q144: After a tax audit, the taxpayer receives

Q146: ASC 740 (FIN 48) addresses how an