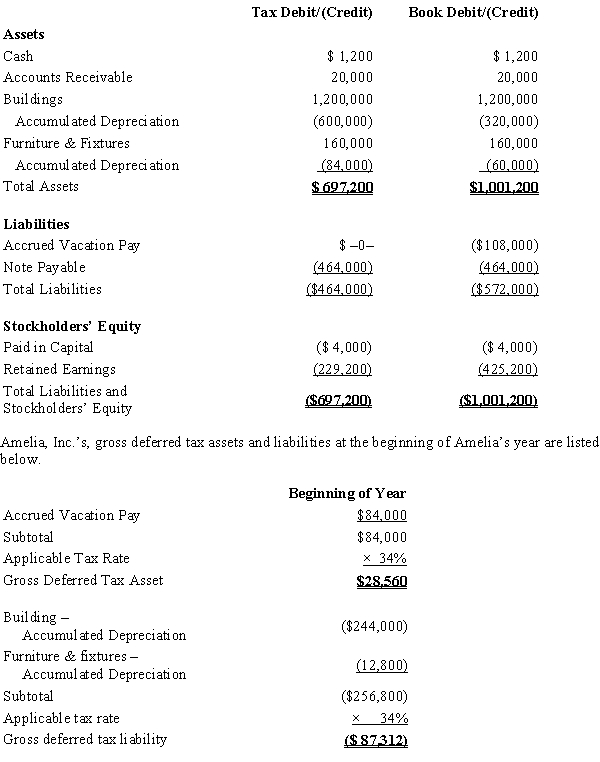

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. Calculate Amelia's current tax expense.

Definitions:

Tangible issues

Problems or matters that can be quantified or measured, often having a physical dimension or concrete implications.

Intangible issues

Issues that are not easily quantified or measured, often related to emotional, psychological, or cultural factors.

Bargaining mixes

The range of items that are up for negotiation between parties, including issues and interests.

Consulting

The professional practice of providing expert advice in a particular area, such as business, education, law, or technology.

Q19: Randall owns 800 shares in Fabrication, Inc.,

Q31: Distribution of cash of $10,000 to a

Q51: Federal agencies exempt from Federal income tax

Q73: The "IRS's attorney" is known as the

Q81: Debt-financed property consists of all real property

Q86: In the purchase of a partnership, does

Q88: Unstated goodwill<br>A)Includes the partner's share of partnership

Q101: Substantially appreciated inventory<br>A)Cash basis accounts receivable, for

Q104: Property taxes generally are collected by local

Q109: Zach's partnership interest basis is $100,000. Zach