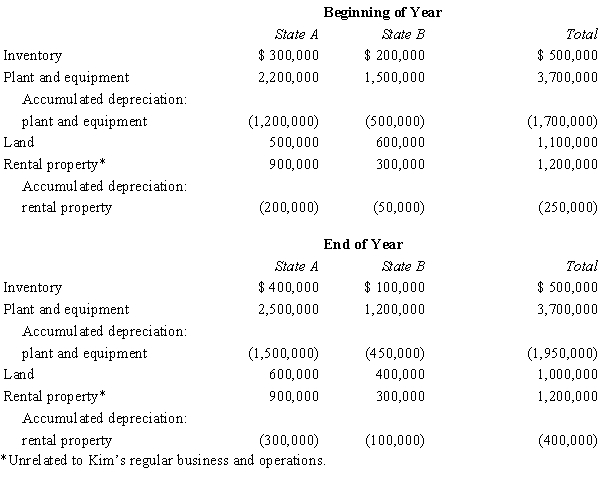

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim's property holdings follows.  Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Definitions:

Leg Cramps

Involuntary and often painful contractions of the muscles in the leg, commonly affecting the calf muscles.

Somatic Symptom Disorder

A psychological disorder involving persistent and significant focus on physical symptoms, such as pain, that cause major distress or problems in functioning.

Physical Symptoms

Observable or felt signs of illness or injury, potentially involving any part of the body.

Psychogenic Disorders

Mental health conditions that are believed to arise from psychological or emotional rather than physical causes.

Q24: Q adopts a sales-only apportionment formula.<br>A)No change

Q42: Only certain exempt organizations must obtain IRS

Q59: Filing an improper refund claim.<br>A)Taxpayer penalty<br>B)Tax preparer

Q85: A disclaimer by a surviving spouse will

Q102: The _ tax levied by a state

Q132: Compute the overvaluation penalty for each

Q138: A Federal gift tax return does not

Q147: The throwback rule requires that:<br>A)Sales of tangible

Q168: The IRS decides upon audit whether the

Q172: In 2000, Irv creates a revocable trust,