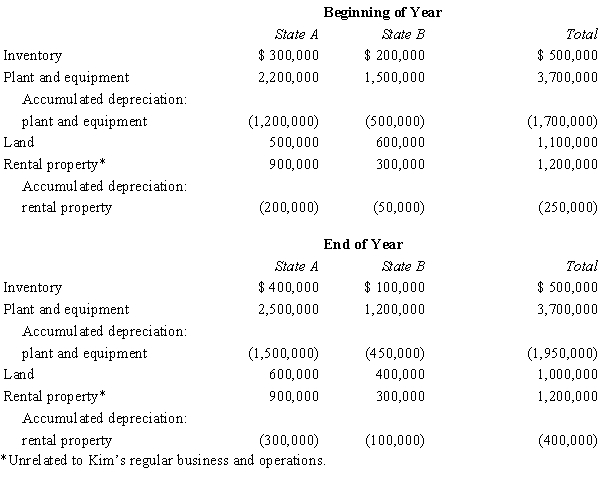

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim's property holdings follows.  Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Definitions:

Par Value

A nominal value of a security or stock set by the issuing company, which may not reflect its market value.

Premium

An amount paid for an insurance policy or the amount by which a bond or stock sells above its face value.

Callable Bonds

Bonds that can be redeemed by the issuer before their maturity date at a predetermined call price.

Stated Dollar Amount

A specific monetary value declared or agreed upon, which is often used in financial contexts for contracts or transactions.

Q3: A CPA can take a tax return

Q13: At the time of her death in

Q21: The Treasury issues "private letter rulings" and

Q22: Concerning a taxpayer's requirement to make quarterly

Q48: Gravel, Inc., earns book net income before

Q72: What tax rates apply for the AMT

Q75: Tenancy in common<br>A)In the current year, Debby,

Q107: Curt owns the following assets which

Q125: Which of the following independent statements correctly

Q146: Prior to his death in 2016,