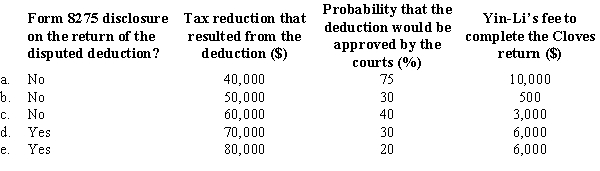

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Weighted-Average Method

A costing method that averages the costs of goods available for sale during the period for the calculation of cost of goods sold and ending inventory.

Processing Department

A specific unit within a manufacturing facility where a distinct phase of production is carried out, like assembly or packaging.

Cost Per Unit

This refers to the total expense incurred to produce, store, and sell one unit of a product or service.

Materials

The raw items or components used in the production of goods.

Q20: At the time of his death,

Q33: Which of the following attributes are associated

Q56: Form 1023<br>A)Return of Private Foundation.<br>B)Application for Recognition

Q92: In 2016, Donna's father dies and leaves

Q96: A number of court cases in the

Q105: Bingo games<br>A)Distribution of such items is not

Q109: The Dispensary is a pharmacy that

Q123: In April 2015, Tim makes a gift

Q127: The IRS can require that the taxpayer

Q129: Milt Corporation owns and operates two