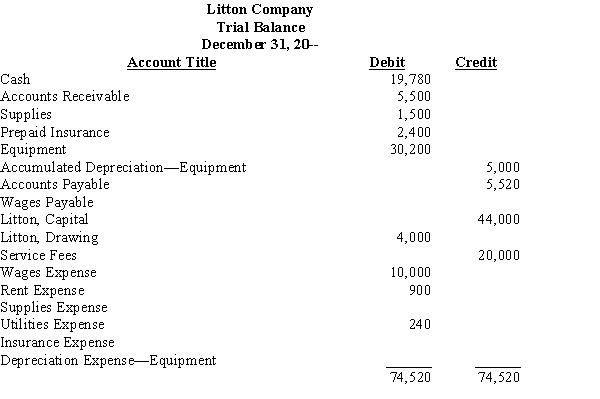

The trial balance and information for year-end adjustments for Litton Company are as follows:

a.

Ending inventory of supplies is $800 at December 31, 20--.

b.

Unexpired insurance as of year-end is $600.

c.

Depreciation of equipment is $5,000.

d.

Wages earned but not paid as of year-end are $1,700.

Prepare the necessary year-end adjustments on a 10-column work sheet (identify each adjustment by letter), and complete the work sheet.

Definitions:

Attorney Fees

Costs for legal services provided by a lawyer or law firm which a court may order the losing party to pay or that may be included in a settlement.

Compensatory Damages

Monetary compensation awarded to a plaintiff to compensate for actual losses or injuries suffered due to the defendant's actions.

Assault Victim

An individual who has suffered harm from an intentional act of physical violence or threat made against them.

Medical Expenses

Costs incurred for healthcare services, including treatments, surgeries, medications, and hospital stays.

Q7: Refer to Figure 11-2. What is the

Q9: The FUTA tax applies to all employee

Q11: In an activity-based cost system, what types

Q30: Prepaid Insurance is an asset account.

Q35: The first document created in the purchasing

Q38: All of the following are unit-based activity

Q49: The income statement and statement of owner's

Q59: One-half of the self-employment tax is really

Q66: The employee's earnings record is a summary

Q66: Adjusting entries are recorded and posted after