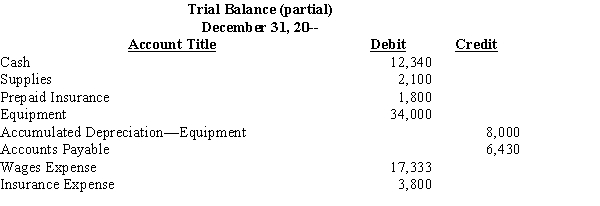

Journalize the necessary year-end adjusting entries based on the following account balances before adjustments.

a.

The inventory of supplies on hand at December 31, 20--, was $230.

b.

The 4-month insurance premium of $1,800 was purchased on December 1, 20--.

c.

The $34,000 of equipment was purchased on January 1, two years ago. It has a salvage value of $2,000. Straight-line depreciation was used to compute depreciation at the end of last year.

d.

Wages accrued at December 31, 20--, were $3,700.

Definitions:

Conversion Costs

The combined costs of direct labor and manufacturing overheads involved in transforming raw materials into finished goods.

Direct Labor

The wages paid to workers who are directly involved in the production of goods or services.

Manufacturing Overhead

Factory overhead expenses that arise during the production process of a product.

Accounts Receivable

The money owed to a business by its customers for goods or services that have been delivered but not yet paid for.

Q6: A trial balance is a list of

Q12: A complete set of all the accounts

Q32: The month in the journal is recorded<br>A)

Q34: The activity-based resource usage model improves managerial

Q43: A schedule of accounts payable is used

Q46: The principal accounting officer of a company

Q51: The petty cash payments record indicates classified

Q54: A petty cash fund of $200 has

Q59: The depositor's checks paid by the bank

Q75: Adjustments at the end of the period