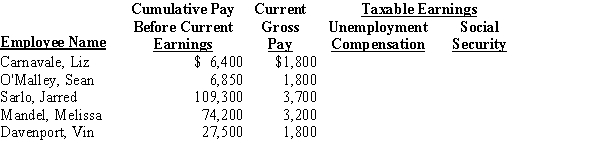

From the following information from the payroll register of Veronica's Auto Supply Store, calculate the amount of taxable earnings for unemployment and FICA tax, and prepare the journal entry to record the employer's payroll taxes as of April 30, 20--. Social Security tax is 6.2% on the first $94,200 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Definitions:

Fixed Asset Turnover

A financial ratio that measures a company's effectiveness in generating revenue from its fixed assets, such as property, plant, and equipment.

Sales

The activities involved in selling goods or services in return for money or other compensation.

Beginning Fixed Assets

The value of a company's long-term tangible assets at the start of a fiscal period.

Fixed Asset Turnover

A efficiency ratio that indicates how well a company uses its fixed assets to generate sales.

Q5: When perpetual inventory records are kept, the

Q14: By January 31 each year, employers must

Q20: The following information was taken from the

Q26: Purchases Returns and Allowances is the contra-purchases

Q37: The matching principle offers the best measure

Q40: Employers may use the wage-bracket method to

Q46: Assets that are used in the operation

Q49: The Income Summary account is used to<br>A)

Q54: Almost any document that provides information about

Q81: The ending balance for merchandise inventory is