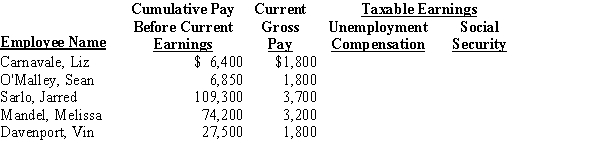

From the following information from the payroll register of Veronica's Auto Supply Store, calculate the amount of taxable earnings for unemployment and FICA tax, and prepare the journal entry to record the employer's payroll taxes as of April 30, 20--. Social Security tax is 6.2% on the first $94,200 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Definitions:

Sclera

the white outer layer of the eyeball, serving as a protective coating.

Pupil Dilate

The process where the pupil, the opening in the center of the iris of the eye, becomes larger to allow more light to enter.

Cataract

A condition where the eye's lens becomes opaque, causing diminished eyesight.

Macular Degeneration

A medical condition which may result in blurred or no vision in the center of the visual field due to damage to the retina.

Q16: A cash shortage is entered as a

Q24: A formal statement of the assets, liabilities,

Q25: A computer system based on a software

Q25: A widely used method of allocating merchandise

Q30: A twelve-month period for which financial reports

Q42: After the temporary owner's equity and drawing

Q63: When assets are recorded at original value,

Q64: The bank on which the check is

Q71: Base and rate changes in payroll taxes

Q73: The steps involved in accounting for all