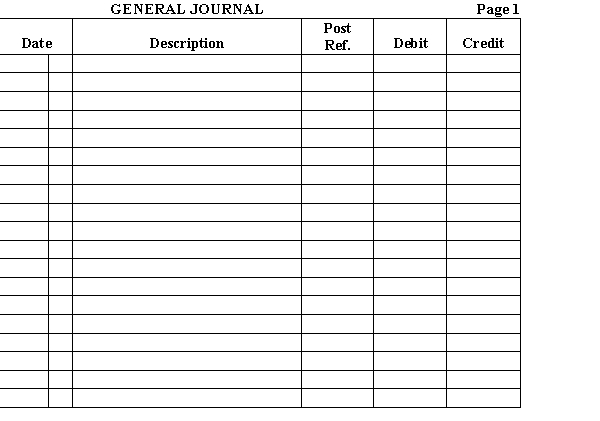

During the month of September, the following transactions occurred. The applicable sales tax rate is 6%. Enter the transactions in the general journal. Sept. 2 Sold merchandise on account to Sam Larson, , plus sales tax.

7 Sold merchandise on account to David Mitchell, , plus sales tax.

12 Issued credit memorandum to Sam Larson for , including sales tax of .

22 Sold merchandise on account to Matt Feustal, , plus sal es tax.

28 Sold merchandise on account to Ana Cardona, , plus sales tax.

Definitions:

Custom Duties

Taxes imposed on the import and export of goods between countries.

Procedural Due Process

Legal doctrine that requires the government to follow fair procedures before depriving a person of life, liberty, or property.

Entitlements

Benefits or rights granted by law, such as Social Security in the United States.

Social Security

A government program that provides financial assistance to people who are retired, disabled, or survivors of deceased workers.

Q8: Which of the following is NOT a

Q19: (Appendix) The three types of business activities

Q29: The following account balances are those of

Q32: Which of the following is a payroll

Q39: Purchases merchandise such as clothing, furniture, or

Q43: Which of the following accounts would NOT

Q62: The increasing use of computers and optical

Q89: The period of time required to purchase

Q91: To reconcile the bank statement, which of

Q101: Accounting for revenue on a cash basis