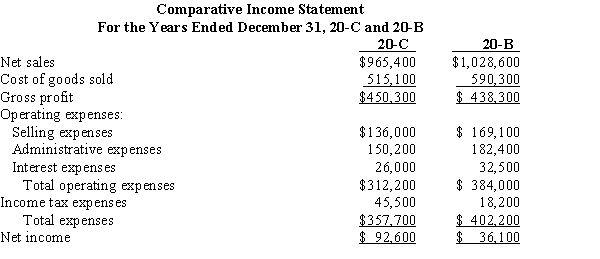

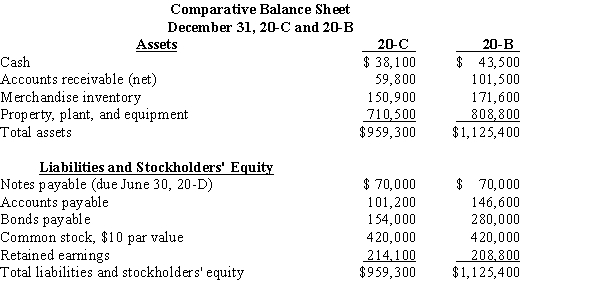

Use the comparative income statements and balance sheets below to complete the required ratio analysis.

Additional information:

Additional information:

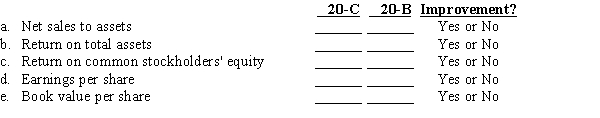

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding 42,000. Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

Definitions:

Annual Dividend

The total dividend payments a company makes to its shareholders in one year.

Increase Annually

A repeated growth or rise in value or amount each year.

Common Stock

A type of equity security that represents ownership in a corporation, entitling the holder to a share of the company's profits through dividends and/or capital appreciation.

Straight Voting

Procedure where a shareholder may cast all votes for each member of the board of directors.

Q11: Capital stock that has been sold and

Q14: Even if there are both appropriated and

Q23: Sanchez and Santos had the following transactions

Q33: A good statistical indicator to avoid the

Q49: Which of the following is NOT a

Q53: The subsidiary ledger in which a separate

Q55: An invoice of $420.00 is received with

Q64: The mean should always be rounded to

Q80: A number that describes numerical data is

Q92: The credit terms, 2 / 10, EOM,