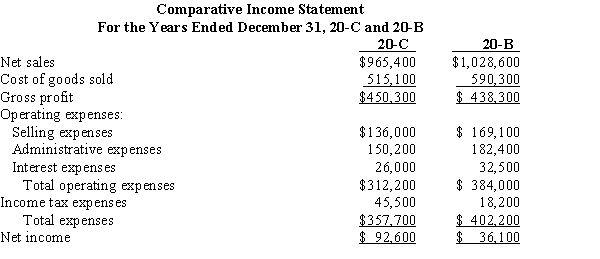

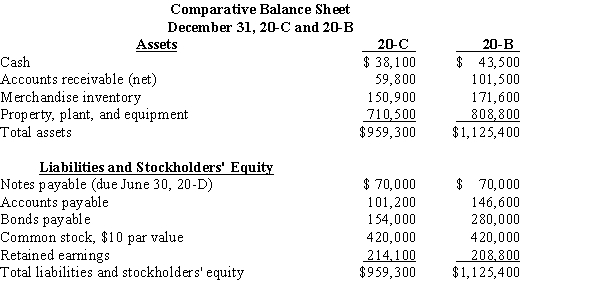

Use the comparative income statements and balance sheets below to complete the required ratio analysis.

Additional information:

Additional information:

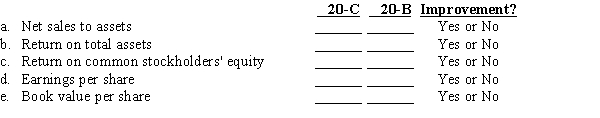

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding 42,000. Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

Definitions:

Economic Development

The process through which a nation improves the economic, political, and social well-being of its people.

Saving and Investment

The act of setting aside income for future use and the use of those savings for purchasing capital goods or financial assets.

Productivity of Labor

The measure of output per worker or per hour worked, indicating how effectively labor inputs are converted into goods or services.

Q3: Stock that has certain preferences or rights

Q6: (Appendix) Payments to employees and to the

Q12: The amount of uncollectible accounts is adjusted

Q12: The financial statements of a business are

Q14: The ratio of operating income to net

Q29: Athletic Apparel and Sports Supplies are departments

Q48: Liquidity measures are intended to indicate an

Q67: While bonds and notes are both formal

Q84: October 27 is 40 days from December

Q91: A smaller standard deviation indicates that the