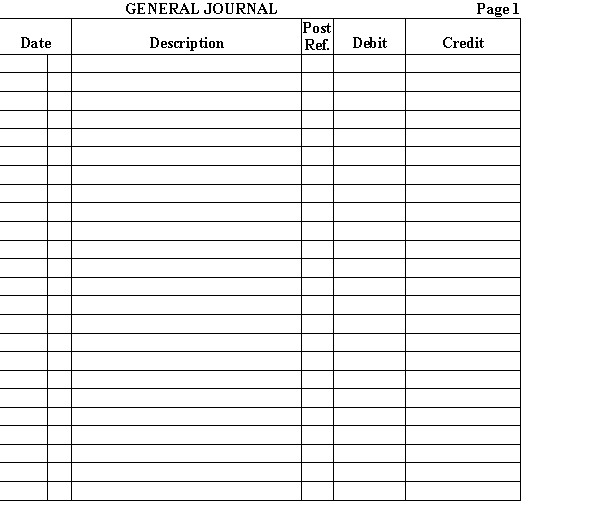

Prepare the year-end adjusting entries in general journal form for Dombrowski Corporation. Information for the year-end adjustments is as follows:

Definitions:

Income Tax Expense

The amount of money a company owes in taxes based on its taxable income for a given fiscal period.

Cost Method

An accounting method used for investments, where the investment is recorded at cost and earnings from the investment are recognized only when dividends are received.

Retained Earnings

The portion of a company's profit that is held or retained and not paid out as dividends to shareholders.

Common Shares

A type of equity investment representing ownership in a corporation, with rights to dividends and voting at shareholder meetings.

Q11: 64% of what number is 57?<br>A) rate

Q12: The financial statements of a business are

Q13: Wages paid to those employees who devote

Q22: A company has cash, $85,000; temporary investments,

Q25: An example of a cash inflow from

Q33: Direct expenses are assigned to departments based

Q54: A bond issue of $500,000 selling at

Q61: The document that shows all operating expenses,

Q75: Under the indirect method, Depreciation Expense must

Q97: The use of a periodic inventory system