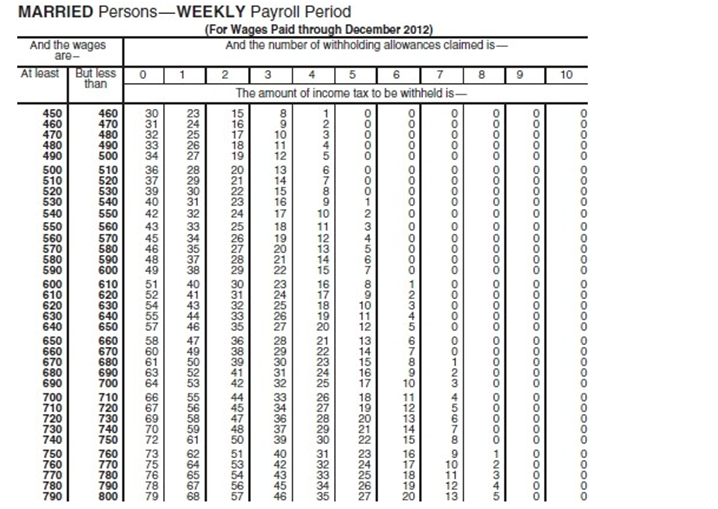

-Ann Preston is married, has a gross weekly salary of $543.74 (all of which is taxable) , and the number of withholding allowances she claims is 1. Use the tax tables to find the federal tax withholding to be deducted from her weekly salary.

Definitions:

Medicare Tax

A federal tax deducted from employees' paychecks to fund the Medicare program, which provides healthcare to seniors.

Federal Withholding

The amount of an employee's pay withheld by the employer and sent directly to the government as partial payment of taxes.

Taxable Income

The amount of an individual's or a corporation's income used to determine how much tax is owed to the government.

Married Filing Jointly

A tax filing status for married couples who choose to combine their income and deductions on a single tax return.

Q16: The percent 1.02% written as a decimal

Q19: If employees are paid biweekly, they receive

Q24: (Figure: Price Ceilings and Random Allocation) Refer

Q30: The need for tellers has been completely

Q37: Hillcrest Medical Center has a severe shortage

Q48: If a note is dated July 15,

Q50: The bank increases your account balance when

Q53: The price of an item on the

Q89: Deadweight loss occurs when:<br>A) consumer surplus transforms

Q98: Henry Daniels earns $2709 biweekly. He is