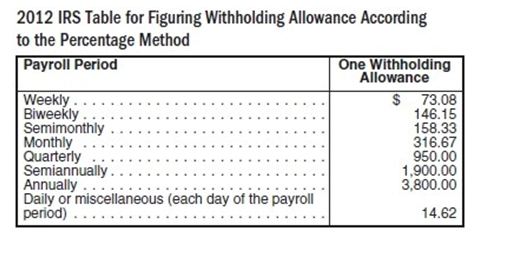

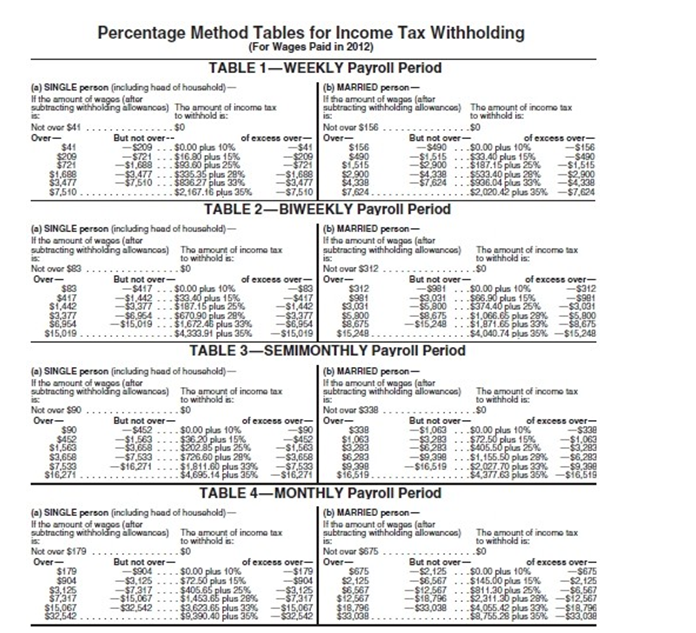

-Irene Farley earns a semimonthly salary of $7714.27. She has a $100 adjustment-to-income flexible benefits package, is married, and claims 4 withholding allowances. Find the federal tax withholding to be deducted from her semimonthly paycheck using the percentage method tables.

Definitions:

Peripheral Nervous System

That part of the nervous system that lies outside the brain and spinal cord, which includes the nerves that extend to the limbs, organs, and the body's periphery.

Central Nervous System

The part of the nervous system consisting of the brain and spinal cord, responsible for processing and sending out information throughout the body.

Endocrine System

A system of glands that secrete hormones into the bloodstream, regulating processes such as growth, metabolism, and mood.

Sensory Systems

The parts of the nervous system responsible for processing sensory information, enabling individuals to perceive their surroundings.

Q14: In the process of reconciliation which of

Q18: If a minimum wage is posted in

Q20: The March 1 unpaid balance in an

Q34: To divide by a fraction, divide the

Q34: When solving an equation containing more than

Q39: The percent of Social Security tax charged

Q52: Which of the following items is not

Q64: A markdown is:<br>A) only based on selling

Q89: Derek Daniels earns $22,312.15 monthly, is married,

Q209: When the price ceilings on oil and