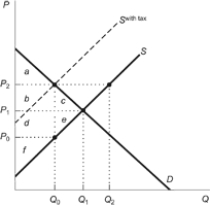

Figure: Commodity Tax

Use the figure to answer the following questions.

a. What is the size of the tax?

b. What is the equilibrium quantity before the tax?

c. What is the equilibrium quantity with the tax?

d. What is the price consumers pay before taxes?

e. What is the price consumers pay with the tax?

f. What is the price sellers receive before taxes?

g. What is the price sellers receive with the tax?

h. What is the deadweight loss of the tax?

i. What is the government tax revenue?

j. What is consumer surplus before the tax?

k. What is consumer surplus with the tax?

l. What is producer surplus before the tax?

m. What is producer surplus with the tax?

Definitions:

Indifference Curves

Graphical representations in economics showing different combinations of goods that give a consumer equal satisfaction and utility.

Affordable

Describes something that is reasonably priced, or within one's financial means.

Income Earns

The compensation received by an individual or generated by an entity in exchange for labor or services or as earnings from investments.

Afford

The financial capacity to purchase something, indicating that the cost does not exceed the buyer’s purchasing power or budget constraints.

Q35: How do speculators mitigate shortfalls in the

Q36: Asphalt is the refined residue from crude

Q38: With a subsidy to producers, supply:<br>A) increases.<br>B)

Q52: If buyers pay $10 per unit and

Q63: Which statement about the computer chip market

Q88: Which statement explains why prices are so

Q171: Suppose that sellers require $6.70 per unit

Q214: The advantages of prediction markets include:<br>A) the

Q242: A forward market allows for the exchange

Q266: War is expected to break out in