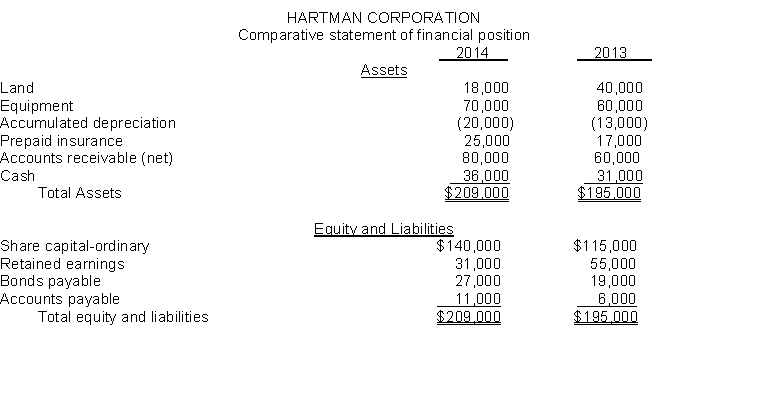

A comparative statement of financial position for Hartman Corporation is presented below:  Additional information:

Additional information:

1. Net loss for 2014 is $15,000.

2. Cash dividends of $9,000 were declared and paid in 2014.

3. Land was sold for cash at a loss of $7,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5. $12,000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for ordinary shares. The fair value of the shares at the time of the exchange was $25,000.

Instructions

Prepare a statement of cash flows for the year ended 2014, using the indirect method.

Definitions:

Specific Performances

A legal remedy where a court orders a party to perform their contractual duties, rather than seeking monetary damages.

Injunctions

Court orders that require a party to do or refrain from doing specific actions.

Medieval England

Refers to the period in English history from the 5th to the late 15th centuries, characterized by feudalism, knights, and castles.

Adequate Remedy

A legal remedy considered sufficient and proportional to redress a harm or violation, making further litigation unnecessary.

Q17: Companies close the Fair Value Adjustment-Trading account

Q77: The slope of a line parallel to

Q118: Nagen Company had these transactions pertaining to

Q156: On January 1, 2014, Bartley Corp. paid

Q166: A positive economic statement simply describes what

Q186: Using borrowed money to increase the rate

Q211: Silas Corporation had net income of $200,000

Q229: Prior period adjustments to income are reported

Q241: New Corp. issues 2,000 ordinary shares with

Q242: Straight line CD in Exhibit 1A-5 shows