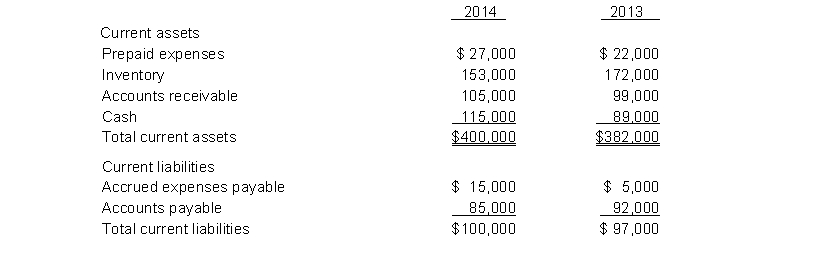

The current sections of Robertson Inc.'s statement of financial position at December 31, 2013 and 2014, are presented here.

Robertson's net income for 2014 was $203,000. Depreciation expense was $29,000.  Instructions

Instructions

Prepare the net cash provided by operating activities section of the company's statement of cash flows for the year ended December 31, 2014, using the indirect method.

Definitions:

CCA Class

A categorization in Canadian tax law that determines the depreciation rate for tax purposes on capital assets.

Depreciation Tax Shield

A reduction in taxable income for a business, resulting from the depreciation expense claimed on tangible assets.

Tax Rate

The percentage of income or value that is collected by the government as tax.

MACRS Depreciation

A method of depreciation in the U.S. that allows for a faster write-off of assets under the tax code.

Q8: In Wallace Company, net income is $290,000.

Q15: The cost method of accounting for long-term

Q38: The payment of interest on bonds payable

Q45: In preparing a statement of cash flows,

Q63: A statement of cash flows should help

Q65: Operating expenses + an increase in prepaid

Q172: A company that owns more than 50%

Q172: The board of directors must assign a

Q182: Desmond Corporation owns 3,500 of the 10,000

Q228: At December 31, 2014, the trading securities