Which of the following adjustments to convert net income to net cash provided by operating activities is correct?

Definitions:

Payroll Deductions

Amounts subtracted from an employee's gross salary for taxes, insurance premiums, benefits, and other payroll-related charges.

Liabilities

Debts or duties a firm has towards third parties, necessitating repayment through the allocation of economic advantages over time.

Federal Unemployment Taxes

Taxes imposed on employers to fund the federal government's oversight and support of state unemployment insurance programs.

FUTA

The Federal Unemployment Tax Act (FUTA) is a United States federal law that imposes a payroll tax on employers to fund state workforce agencies.

Q7: Corporations can pay dividends out of share

Q30: Assume the following cost of goods

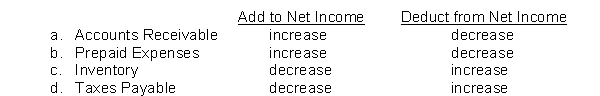

Q98: Assume the indirect method is used to

Q149: The sale of equipment at less than

Q152: Noell Corp. has share capital of $5,000,000,

Q163: Profitability ratios are frequently used as a

Q164: Microeconomics is the branch of economics in

Q165: Classify each of the following as a(n):

Q173: On the statement of cash flows using

Q174: Straight line AB in Exhibit 1A-3 shows