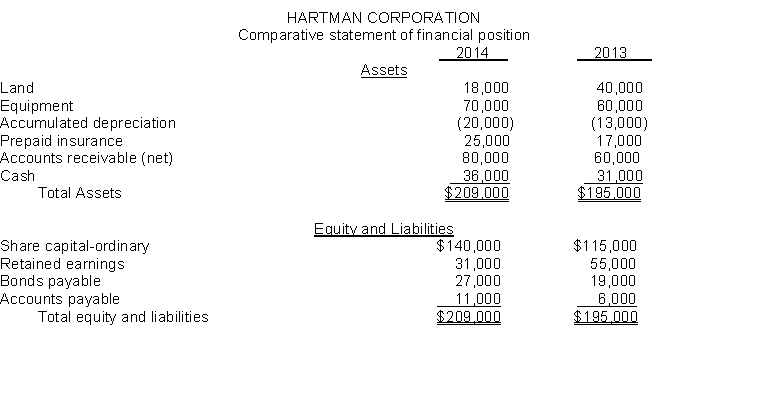

A comparative statement of financial position for Hartman Corporation is presented below:  Additional information:

Additional information:

1. Net loss for 2014 is $15,000.

2. Cash dividends of $9,000 were declared and paid in 2014.

3. Land was sold for cash at a loss of $7,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5. $12,000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for ordinary shares. The fair value of the shares at the time of the exchange was $25,000.

Instructions

Prepare a statement of cash flows for the year ended 2014, using the indirect method.

Definitions:

Bad Account

An account receivable that has been deemed uncollectible and is written off as a loss.

Pre-Reconciliation Cash Balance

The cash balance reported in accounting records before adjustments are made for reconciling items in a bank reconciliation.

Outstanding Checks

Checks that have been written and recorded in a company's financial ledger but have not yet been cashed or cleared by the bank.

Deposits in Transit

Funds that have been deposited by a company but not yet recorded by the bank, often causing a discrepancy in the bank statement versus the company’s record.

Q102: During the year, Income Tax Expense amounted

Q115: Consolidated financial statements are prepared when a

Q122: Companies report most changes in accounting principle

Q159: The statement "Cutting government spending is the

Q201: The effect of a share dividend is

Q202: Selected transactions for the Eldon Company are

Q208: During the year, Salaries and Wages Payable

Q210: The following financial statement information is

Q313: Freidrichs Company has issued and outstanding 11,000

Q344: Preference shareholders have the right to receive