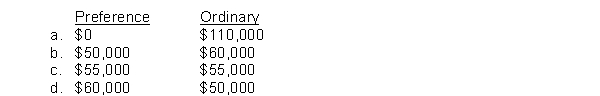

Norton, Inc. has 10,000 shares of 5%, $100 par value, noncumulative preference shares and 100,000 ordinary shares with a $1 par value outstanding at December 31, 2013, and December 31, 2014. The board of directors declared and paid a $40,000 dividend in 2013. In 2014, $110,000 of dividends are declared and paid. What are the dividends received by the preference and ordinary shareholders in 2014?

Definitions:

Direct Materials Cost

The expense associated with acquiring raw materials that are directly utilized in the manufacture of goods.

Traditional Costing

Traditional costing is an accounting method that allocates manufacturing overhead based on volume-related measures, such as direct labor hours or machine hours.

Production Orders

Instructions for manufacturing a certain number of products, detailing the materials, components, and assembly or production processes required.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities based on their use or consumption.

Q24: On January 1, 2014, Bentley Company issued

Q40: The market price of a bond

Q56: <sup> </sup>207. On January 1, Martinez Inc.

Q111: During 2014, Pine Corporation had the following

Q123: During 2014, Baxter Company sold a building

Q130: The information to prepare the statement of

Q189: As interest is recorded on an interest-bearing

Q222: Manner, Inc. has 5,000 shares of 6%,

Q316: <sup> </sup>200. When the effective-interest method of

Q316: King George Company was authorized to issue