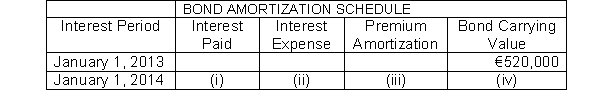

213. Presented here is a partial amortization schedule for Courtney Company who sold €500,000, five year 10% bonds on January 1, 2013 for €520,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (ii) ?

Which of the following amounts should be shown in cell (ii) ?

Definitions:

Q59: The following information is available for

Q86: The cost of land does not include<br>A)

Q154: Record the following transactions for Grogan Corporation

Q199: If Vickers Company issues 5,000 ordinary shares

Q206: If ordinary shares are issued for an

Q207: <sup> </sup>201. When the effective-interest method of

Q224: The officer who is generally responsible for

Q241: New Corp. issues 2,000 ordinary shares with

Q299: In most companies, current liabilities are paid

Q309: A retail store credited the Sales Revenue