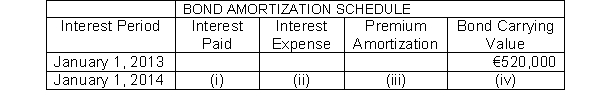

214. Presented here is a partial amortization schedule for Courtney Company who sold €500,000, five year 10% bonds on January 1, 2013 for €520,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (iii) ?

Which of the following amounts should be shown in cell (iii) ?

Definitions:

Equity Multiplier

This financial ratio measures a company's leverage by comparing its total assets to its total shareholders' equity.

Net Profit Margin

A financial metric that shows the percentage of net income relative to revenue, indicating how much profit is generated from each dollar of sales.

Gross Margin

The difference between sales revenue and the cost of goods sold (COGS), indicating the profitability of a company's core business activities.

Times Interest Earned

A financial ratio that measures a company's ability to meet its debt obligations by comparing its earnings before interest and taxes (EBIT) to its interest expenses.

Q2: Depreciation<br>A) Is a process of asset valuation

Q56: A change in the estimated useful life

Q70: Treasury shares are<br>A) shares issued by the

Q77: London Bank and Trust agrees to lend

Q109: Rooney Company incurred $420,000 of research costs

Q176: In calculating depreciation, both plant asset cost

Q187: Under GAAP, a purchase by a company

Q197: Cuther Inc has 1,000 shares of 5%,

Q242: Discount on bonds is an additional cost

Q328: On January 1, Edmiston Corporation had 1,000,000