On January 1, 2012 Marsh Company purchased and installed a telephone system at a cost of ₤20,000. The equipment was expected to last five years with a residual value of ₤3,000. On January 1, 2013 more telephone equipment was purchased to tie-in with the current system for ₤12,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Marsh Company uses the straight-line method of depreciation.

Instructions

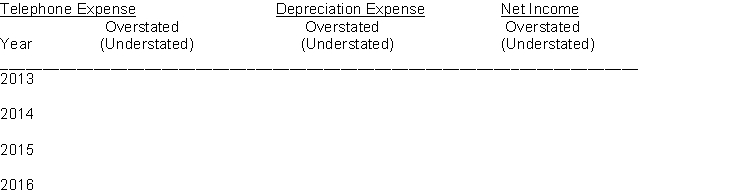

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Definitions:

Disbursements

Payments made by a business in cash or cash equivalents, often pertaining to operating expenses.

Holding Cash

The practice of keeping a portion of assets in liquid cash form as a safeguard against uncertainty or to meet short-term obligations.

Total Float

The total amount of time that a project task can be delayed without causing a delay to subsequent tasks or the project's final deadline.

Q6: Which one of the following items is

Q28: A petty cash fund should not be

Q47: Franco Corporation reports the following selected financial

Q54: Which of the following statements concerning receivables

Q86: The cost of land does not include<br>A)

Q96: The journal entry to record a revaluation

Q101: The market value (present value) of a

Q117: Mather Company purchased equipment on January 1,

Q218: Gowns, Inc. uses the percentage of sales

Q260: Kim Estes and Jeff Malone are discussing