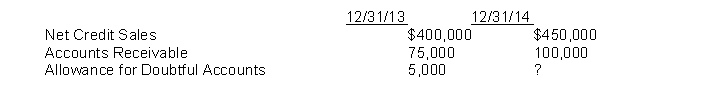

Coffeldt Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 1% of net credit sales will eventually be uncollectible. Selected account balances at December 31, 2013, and December 31, 2014, appear below:  Instructions

Instructions

(a) Record the following events in 2014.

Aug. 10 Determined that the account of Sue Lang for $1,000 is uncollectible.

Sept. 12 Determined that the account of Tom Woods for $4,000 is uncollectible.

Oct. 10 Received a check for $550 as payment on account from Sue Lang, whose account had previously been written off as uncollectible. She indicated the remainder of her account would be paid in November.

Nov. 15 Received a check for $450 from Sue Lang as payment on her account.

(b) Prepare the adjusting journal entry to record the bad debt provision for the year ended December 31, 2014.

(c) What is the balance of Allowance for Doubtful Accounts at December 31, 2014?

Definitions:

Universal Copyright Convention

An international treaty that protects the rights of creators of copyrighted works worldwide.

Intellectual Property Laws

Laws that protect the creations of the mind, including inventions, literary and artistic works, designs, and symbols, names, and images used in commerce.

Literary Works

Intellectual creations expressed in written form, such as novels, poems, plays, and essays, often protected under copyright law.

Berne Convention

An international agreement governing copyright laws to protect the rights of authors over their literary and artistic works across countries.

Q7: The specific identification method of inventory costing<br>A)

Q12: Kline Company had checks outstanding totaling $19,200

Q56: Bosio Corporation's computation of cost of goods

Q74: If goods in transit are shipped FOB

Q77: When the allowance method is used to

Q92: Longfellow Company gathered the following reconciling information

Q127: Which of the following items would be

Q128: The accounts receivable turnover ratio is computed

Q247: Inventory turnover is calculated as cost of

Q257: Under the gross profit method, each of