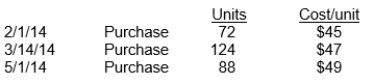

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

Definitions:

Q22: On March 9, Fillmore gave Camp Company

Q71: Checks received in the mail should be

Q77: A bank reconciliation should be prepared<br>A) whenever

Q78: A buyer would record a payment within

Q89: Intangible assets are customarily the first items

Q89: Sales revenues are earned during the period

Q121: The financial statements of Hudson Manufacturing Company

Q146: Short-term, highly liquid investments are currently reported

Q151: Notes receivable are recognized in the accounts

Q230: Because cash is the most liquid current