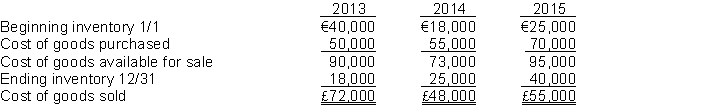

Speer's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:  Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of €20,000 were not recorded in 2013.

2. The 2013 December 31 inventory should have been €21,000.

3. The 2014 ending inventory included inventory costing €8,000 that was purchased FOB destination and in transit at year end.

4. The 2015 ending inventory did not include goods costing €4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Definitions:

Allocation Method

A strategy or system used for distributing resources or costs among various projects, departments, or segments.

Hard Rationing

Hard Rationing occurs when external financial constraints prevent a company from obtaining the capital it needs to expand or continue operations, regardless of profitability.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, determined by a company’s fixed versus variable costs.

Q9: When a seller grants credit for returned

Q40: For each of the following, determine the

Q46: India Eastern Corporation's computation of cost of

Q111: Using prenumbered checks and having an approved

Q138: Cash and office supplies are both classified

Q172: The accounting principle that requires that the

Q184: The responsibility for keeping the records for

Q225: A company maintains the asset account, Cash

Q242: Liabilities are generally classified on a statement

Q248: Taj Mahal Inc. uses the periodic inventory