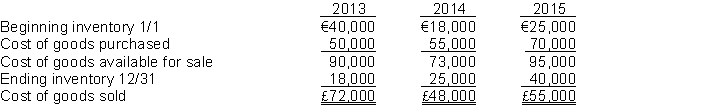

Speer's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:  Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of €20,000 were not recorded in 2013.

2. The 2013 December 31 inventory should have been €21,000.

3. The 2014 ending inventory included inventory costing €8,000 that was purchased FOB destination and in transit at year end.

4. The 2015 ending inventory did not include goods costing €4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Definitions:

Fair Value

The price one would receive for offloading an asset or would pay to reassign a liability during a formal transaction with participants in the market at the time of valuation.

Consolidated Balance

Refers to the presentation of assets, liabilities, and equity in a single balance sheet that combines the financials of a parent company with its subsidiaries.

Parent

In corporate finance, refers to a company that holds a controlling interest in one or more subsidiary companies.

Q5: An error in the physical count of

Q30: If the total debit column exceeds the

Q140: The post-closing trial balance only contains Statement

Q148: Financial information is presented below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3141/.jpg"

Q148: Cash equivalents, such as highly liquid investments

Q157: Aiwa Inc. uses the average-cost inventory method.

Q169: Net sales is sales revenue less<br>A) sales

Q169: The principle of internal control that prevents

Q193: Electronic Funds Transfer (EFT) is a disbursement

Q203: The post-closing trial balance is entered in