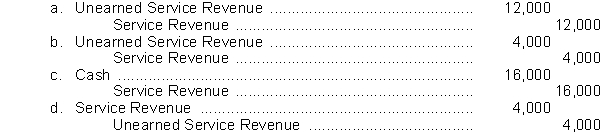

Mike Conway is a lawyer who requires that his clients pay him in advance of legal services rendered. Mike routinely credits Service Revenue when his clients pay him in advance. In June Mike collected $16,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Mike's firm at the end of June?

Definitions:

Team Selling

A sales approach where a group of salespeople work together to sell products or services to customers.

Supply Chain Personnel

Employees involved in managing the flow of goods, services, and information from the supplier to the customer.

Major Retailers

Large and influential retail businesses that operate on a national or international scale, typically dominating market sectors or industries.

Seminar Selling

A sales method that involves organizing educational meetings or workshops aimed at pitching a product or service to potential buyers.

Q26: The primary purpose of the statement of

Q35: Currency signs are typically used only in

Q43: Prepare journal entries for each of the

Q45: Hercules Company purchased a computer for $4,500

Q46: A general ledger should be arranged in

Q136: Cara, Inc. purchased a building on January

Q161: Management consulting includes examining the financial statements

Q165: A chart of accounts usually starts with<br>A)

Q183: If a resource has been consumed but

Q189: The balance in the Prepaid Rent account