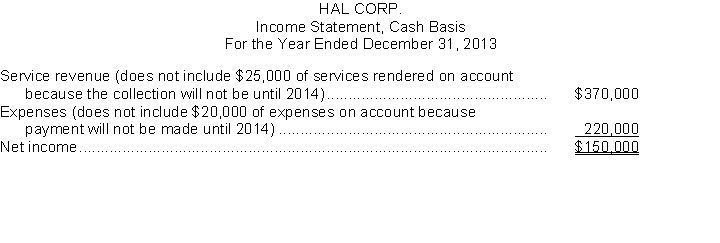

Hal Corp. prepared the following income statement using the cash basis of accounting:  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2013, paid for a two-year insurance policy on the automobile amounting to $2,400. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with IFRS. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Definitions:

Selection

The process by which certain traits become more prevalent in a population because they confer a survival or reproductive advantage.

QTL Association Studies

Quantitative Trait Loci (QTL) association studies are research methods used to identify the genetic locations associated with specific quantitative traits in organisms, such as height, weight, or disease susceptibility.

Phenotypic Variation

The observable differences in appearance and behavior among individuals of the same species due to genetic and environmental influences.

Heritability

A measure of how much of the variation in a trait within a population can be attributed to genetic differences among individuals.

Q21: Prepare the required end-of-period adjusting entries for

Q24: When assets are distributed to the shareholders

Q43: Which of the following is not a

Q44: In general, the shorter the time period,

Q75: The revenue recognition principle dictates that revenue

Q134: The step in the accounting cycle that

Q149: Which classification of assets will appear first

Q163: A trial balance may balance even when

Q181: Journalize the following business transactions in general

Q258: The income statement for the month of