Selected transactions for Sweet Home, a property management company, in its first month of business, are as follows.

Jan. 2 Issued ordinary shares to investors for $15,000 cash.

3 Purchased used car for $4,000 cash for use in business.

9 Purchased supplies on account for $500.

11 Billed customers $1,800 for services performed.

16 Paid $200 cash for advertising.

20 Received $700 cash from customers billed on January 11.

23 Paid creditor $300 cash on balance owed.

28 Paid dividends of $2,000.

Instructions

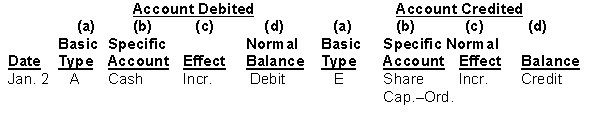

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), equity (E)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

Definitions:

Insurance Company

A business entity that provides coverage, in the form of compensation resulting from loss, damages, injury, treatment, or hardship in exchange for premium payments.

Prospective Payment System

A healthcare payment system where the amount or rate of reimbursement is predetermined before the service is delivered.

Medicare

A federal health insurance program in the United States primarily for people aged 65 and older, as well as for some younger individuals with disabilities.

Healthcare Costs

The expenses related to the provision of health care services, including the costs of medical procedures, drugs, equipment, and hospital stays.

Q22: At January 31, 2014, the balance in

Q106: Accounts maintained within the ledger that appear

Q119: Your friend, James, made this comment:<br>My major

Q163: An adjusted trial balance<br>A) is prepared after

Q163: Liabilities of a company are owed to<br>A)

Q167: Entries in a sales journal are<br>A) posted

Q210: Which of the following statements is false?<br>A)

Q229: FICA taxes withheld and federal income taxes

Q294: A company usually determines the amount of

Q300: An accounting period that is one year