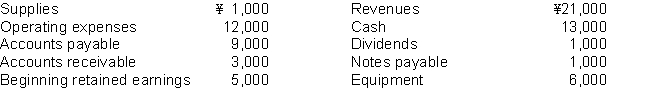

Use the following information to calculate for the year ended December 31, 2014 (a) net income (net loss), (b) ending retained earnings, and (c) total assets.

Definitions:

Schedule C

A form used by sole proprietors to report their business income and expenses to the IRS.

Flow-Through Entities

Business structures where income passes directly to the owners or investors, avoiding corporate income tax.

Intangible Property

Refers to non-physical assets owned by a business or individual, such as patents, trademarks, copyrights, and business goodwill.

Capital Improvements

Permanent structural changes or restorations to a property that enhance its value, prolong its useful life, or adapt it to new uses, with potential tax impacts.

Q2: After a transaction has been posted, the

Q63: The following financial statement information is available

Q74: The current ratio is<br>A) calculated by dividing

Q111: Which of the following statements is true?<br>A)

Q119: Your friend, James, made this comment:<br>My major

Q125: Equity at the end of the year

Q134: Short-term creditors are usually most interested in

Q140: Common size analysis expresses each item within

Q195: DMV leases a building for 20 years.

Q241: On June 6, Wing Wah Inc. purchased