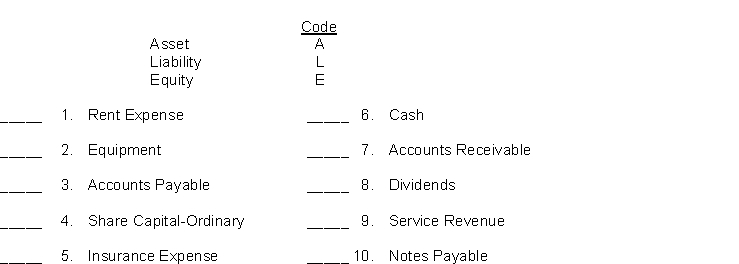

For the items listed below, fill in the appropriate code letter to indicate whether the item is an asset, liability, or equity item.

Definitions:

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated as depreciation expense over its useful life up to a specific date.

Residual Value

The projected worth of a tangible asset upon reaching the conclusion of its operational lifespan.

Depreciation Expense

An accounting method used to allocate the cost of a tangible or physical asset over its useful life.

Straight-Line Method

A method of calculating depreciation of an asset evenly across its useful life, where the same amount is expensed each year.

Q15: The one characteristic that all entries recorded

Q68: At January 1, 2014, LeAnna Industries reported

Q89: Frye Company is considering investing in an

Q92: Postretirement benefits are accounted for on a

Q107: During 2014, its first year of operations,

Q127: The equity at the end of the

Q156: The chart of accounts used by Ming

Q160: On January 11, 2014, Britannica Corporation sold

Q193: If you are able to earn a

Q258: Indicate in the space provided by each