Circle the correct answer to each situation.

Definitions:

Social Security Tax

A mandatory contribution imposed by governments to fund public programs that provide retirement benefits, disability income, and other social security services.

Medicare Tax

A federal tax deducted from employees' wages and employers' pay to fund the Medicare program.

Unemployment Compensation

Payments made by the government or a fund to unemployed workers who meet certain eligibility requirements.

Social Security Tax

Taxes collected from employees and employers to fund the Social Security program, providing retirement, disability, and survivor benefits.

Q5: If a company has both an inflow

Q13: On August 13, 2014, Merrill Enterprises purchased

Q36: Roberts Company is preparing monthly adjusting entries

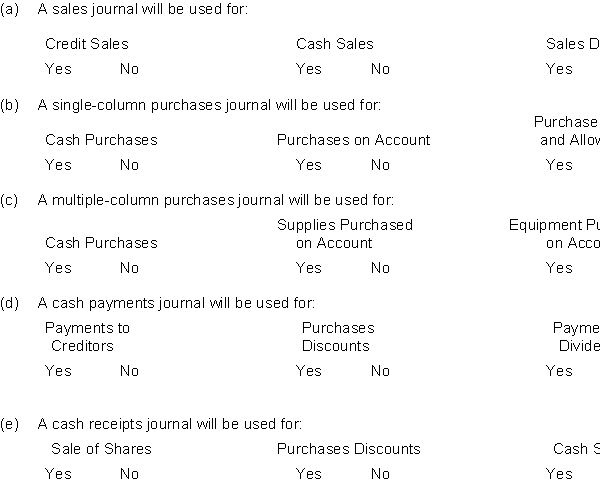

Q49: Gates Company maintains four special journals and

Q50: The transactions of Medina Information Service are

Q51: The statement of cash flows should help

Q123: If a transaction cannot be recorded in

Q131: The payment of interest on bonds payable

Q132: External users of accounting information include all

Q148: The following information is available for Charles