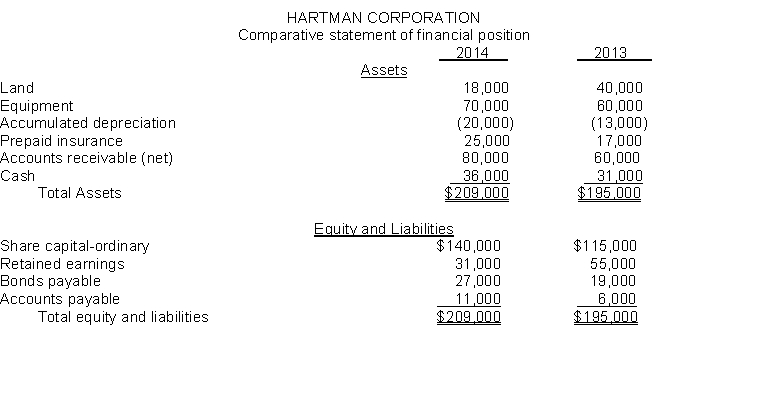

A comparative statement of financial position for Hartman Corporation is presented below:  Additional information:

Additional information:

1. Net loss for 2014 is $15,000.

2. Cash dividends of $9,000 were declared and paid in 2014.

3. Land was sold for cash at a loss of $7,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5. $12,000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for ordinary shares. The fair value of the shares at the time of the exchange was $25,000.

Instructions

Prepare a statement of cash flows for the year ended 2014, using the indirect method.

Definitions:

Buyology

The study of consumer purchasing behavior and the psychological influences behind decision-making.

Genealogy

The study and tracing of lines of descent or the development of families.

Mystery Shoppers

Individuals hired to visit stores, restaurants, or other businesses anonymously to evaluate customer service, product quality, and the overall experience.

Quality

The degree to which a product or service meets or exceeds customer expectations.

Q28: Assume the indirect method is used to

Q34: At December 31, 2014, the trading securities

Q84: Vertical analysis is also called<br>A) common size

Q95: The following information pertains to Soho Company.

Q152: The following information is available for Yates

Q160: Inventory turnover is calculated by dividing<br>A) cost

Q172: *The separate statements of financial position of

Q187: Kerwin Packaging Corporation began business in 2013

Q189: On January 1, 2014, Nott Company purchased

Q224: The accounts receivable turnover is calculated by