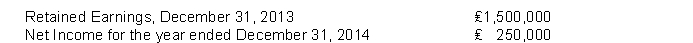

The following information is available for Piper Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2012 and 2013 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was ₤15,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2014.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2014.

Definitions:

Duty

The responsibility or obligation to act in accordance with moral, legal, or professional expectations.

Moral Action

An action undertaken based on a sense of right and wrong, reflecting ethical considerations and values.

Happiness

A state of well-being and contentment characterized by emotional, psychological, and/or physical fulfillment.

Q9: Preference shares have contractual preference over ordinary

Q25: Obligations in written form are called _

Q26: Greyhound Stables, Inc. operates several dog racing

Q31: Milner Corporation had the following transactions pertaining

Q87: Short-term investments are listed on the statement

Q129: Dailey Company is a publicly held corporation

Q176: On October 1, 2013, Pennington Company issued

Q201: Gains on exchanges of assets when the

Q202: The carrying value of bonds at maturity

Q225: If a corporation declares a dividend out