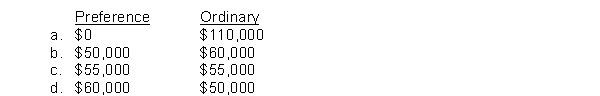

Norton, Inc. has 10,000 shares of 5%, $100 par value, noncumulative preference shares and 100,000 ordinary shares with a $1 par value outstanding at December 31, 2013, and December 31, 2014. The board of directors declared and paid a $40,000 dividend in 2013. In 2014, $110,000 of dividends are declared and paid. What are the dividends received by the preference and ordinary shareholders in 2014?

Definitions:

Appraised Fair Value

The estimated market value of an asset based on the judgment of a qualified appraiser at a specific time.

Cost

The value of economic resources used or the amount of expenditure incurred to acquire or produce a good or service.

Book Value

The net value of an asset as recorded on the balance sheet, calculated by subtracting any associated depreciation or amortization from its cost.

Property

Assets or possessions owned by an individual or company, encompassing both tangible and intangible assets.

Q29: Bent Company reports a $20,000 increase in

Q57: Mehring's 2014 financial statements contained the following

Q77: The unrealized gain or loss on non-trading

Q129: Dailey Company is a publicly held corporation

Q131: Prior period adjustments to income are reported

Q168: On January 1, 2014, Milton Company purchased

Q190: Glaser Company had the following transactions pertaining

Q190: Treasury shares should be reported in the

Q203: Double taxation means that<br>A) the earnings of

Q280: Megan Stone is discussing the advantages of