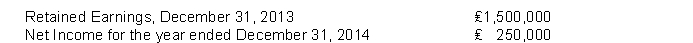

The following information is available for Piper Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2012 and 2013 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was ₤15,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2014.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2014.

Definitions:

Relevant Range

The scope of business activity within which the assumptions about fixed and variable costs are valid.

Average Costs

This represents the total cost of production divided by the number of units produced, indicating the cost per unit.

Variable Production

Refers to the portion of production costs that vary with the level of output, including expenses like raw materials and direct labor.

Fixed Production

A quantity of manufacturing or output that remains constant, regardless of changes in production costs or sales volume.

Q49: Agler Corporation purchased 4,000 of its €5

Q92: Unearned Rent Revenue is<br>A) a contra-account to

Q97: Depletion cost per unit is computed by

Q107: Under the equity method of accounting for

Q123: The cost method of accounting for long-term

Q191: Capital expenditures are expenditures that increase the

Q269: If Vickers Company issues 5,000 ordinary shares

Q297: Outstanding shares of the Abel Corporation included

Q330: A company purchased factory equipment on April

Q336: Which of the following factors does not