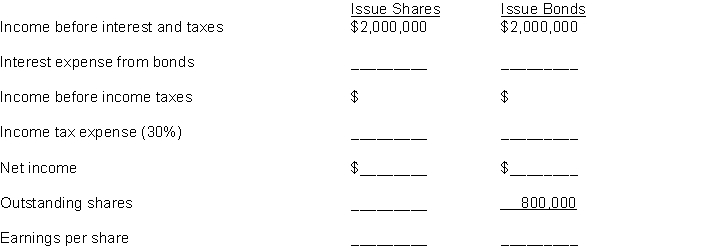

Shaffer Inc. is considering two alternatives to finance its construction of a new $5 million plant.

(a) Issuance of 500,000 ordinary shares at the market price of $10 per share.

(b) Issuance of $5 million, 8% bonds at par.

Instructions

Complete the following table.

Definitions:

Q29: <sup> </sup>Vance Company issued $1,000,000, 10%, 20-year

Q75: Identify which of the following items would

Q115: IFRS allows companies to revalue plant assets

Q138: <sup> </sup>191. ¥1 billion, 8%, 10-year bonds

Q166: The loss on bond redemption is the

Q194: If shares are issued in exchange for

Q195: Shareholders elect the _, who in turn

Q237: Herman Company received proceeds of ₤565,500 on

Q302: Eckman Company purchased equipment for $80,000 on

Q321: The correction of an error in previously