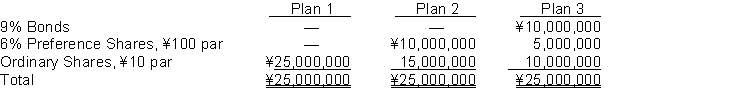

Three plans for financing a ¥25,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount and the income tax rate is estimated at 30%.  It is estimated that income before interest and taxes will be ¥5,000,000.

It is estimated that income before interest and taxes will be ¥5,000,000.

Instructions

Determine for each plan, the expected net income and the earnings per share.

Definitions:

Leading Questions

Questions framed in a way that suggests a particular answer or influences the response, often used in legal settings, interviews, and surveys to shape the respondent's answer.

Cochran and Colleagues

A group of researchers known for their contributions to a specific field or study, though the context of their work would determine their specific domain of expertise.

Eyewitnesses

Individuals who have directly observed an event and can provide a first-hand account or testimony of that event.

Reliability

The degree to which an assessment tool produces stable and consistent results over time.

Q53: Par value of shares represents the _

Q70: A truck was purchased for ¥180,000 and

Q79: Ski Quarterly typically sells subscriptions on an

Q136: The corporate charter of Gregory Corporation allows

Q143: Shareholders generally have the right to share

Q162: Retained earnings are occasionally restricted<br>A) to set

Q239: James Corporation issued 3,000 preference shares with

Q289: The following items were shown on the

Q305: On October 1, 2014, Holt Company places

Q318: The depreciable cost of a plant asset